If you have an enclosed trampoline on your property, you are not required to inform your homeowners insurance of its existence. However, if the trampoline is not enclosed and someone is injured while using it, your homeowners insurance may be liable for damages.

Most homeowners insurance policies will cover trampolines, but it’s important to check with your insurer to be sure. Some insurers may require you to disclose the presence of a trampoline on your property when you apply for coverage, or they may exclude coverage for injuries that occur on the trampoline.

If you’re considering installing a trampoline on your property, be sure to talk to your homeowners insurance agent first.

They can help you understand what impact the trampoline may have on your coverage and rates.

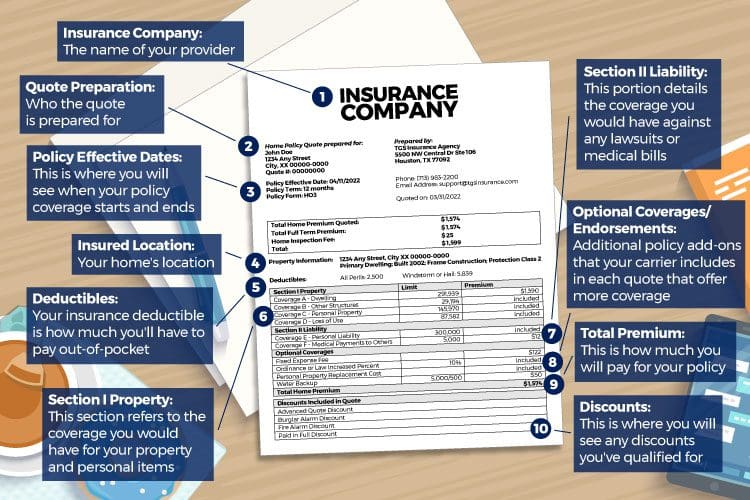

Homeowners Insurance 101 What you need to know

Progressive Homeowners Insurance Trampoline

Progressive Homeowners Insurance offers trampoline insurance to help protect your family and friends while they’re enjoying this popular backyard activity. This type of insurance can help cover the cost of medical bills if someone is injured while using the trampoline, as well as property damage if the trampoline causes any damage to your home or other property.

Trampoline Homeowners Insurance Massachusetts

As a homeowner in Massachusetts, you are most likely aware that your standard homeowners insurance policy does not cover trampolines. This is because they are considered to be high-risk items and can pose a liability risk if someone is injured while using them. While some insurance companies may offer riders or endorsements to add trampoline coverage to your policy, it is not required by law.

If you do have a trampoline on your property, it is important to make sure that it is properly installed and maintained in order to minimize the risk of injury. You should also check with your local municipality to see if there are any regulations or restrictions in place regarding the use of trampolines.

While there is no guarantee that you will never have an accident or incident involving your trampoline, taking these precautions can help to reduce the chances of something happening.

In the event that someone is injured while using your trampoline, having proper insurance coverage in place can help to ensure that you are not held liable for their medical expenses or other damages.

Homeowners Insurance Trampoline State Farm

Is your home protected against trampoline accidents?

If you have a trampoline, it’s important to make sure that your homeowners insurance policy will provide coverage in the event of an accident. Unfortunately, many homeowners policies exclude coverage for injuries caused by trampolines.

If you’re considering purchasing a trampoline, or if you already have one, check with your insurance agent to see if your policy provides coverage. If it doesn’t, you may want to purchase a separate liability policy to protect yourself from financial damages in the event of an accident.

At State Farm, we understand the importance of protecting your family and your property.

That’s why we offer comprehensive homeowners insurance coverage that includes protection for trampoline accidents. Contact your local State Farm agent today to learn more about our policies and how we can help keep you and your family safe.

Usaa Homeowners Insurance Trampoline

When most people think of USAA, they think of its auto insurance policies. However, the company also offers a variety of other types of insurance, including homeowners insurance. One feature that makes USAA’s homeowners insurance stand out is its trampoline coverage.

While most homeowners insurance policies will not cover damage caused by a trampoline, USAA’s policy does provide limited coverage for trampolines. This coverage is designed to protect the home in the event that the trampoline causes damage to the property or injures someone on the premises.

The amount of coverage provided by USAA’s policy varies depending on the value of the home and the size of the trampoline.

However, it is important to note that this coverage is only available if the trampoline is used for recreational purposes and not for commercial use.

Geico Homeowners Insurance Trampoline

In the market for homeowners insurance? You might want to think twice before adding a trampoline to your backyard.

While they may be fun for the kids, trampolines can pose a serious liability risk.

That’s why some insurers are hesitant to cover homes with trampolines – and those that do often charge higher premiums.

There’s no denying that trampolines can be dangerous. According to the Consumer Product Safety Commission, there were nearly 100,000 trampoline-related injuries in the US in 2015.

The most common injuries are fractures and sprains, but more serious injuries like concussions and spinal cord damage can also occur.

So what does this mean for you? If you’re thinking about buying a trampoline or already have one in your yard, it’s important to understand how it could impact your homeowners insurance coverage.

Some insurers may refuse to cover your home at all if you have a trampoline, while others may limit or exclude coverage for any accidents that occur on the property.

Ultimately, it’s up to each individual insurer whether or not they’re willing to provide coverage for homes with trampolines. So if you’re shopping around for homeowners insurance, be sure to ask about their stance on trampolines – it could end up saving you a lot of money in the long run.

Trampoline Insurance for Renters

If you’re renting a trampoline, you may be wondering if you need to get insurance. The answer is maybe. It depends on your individual circumstances.

If you’re renting from a private individual, their homeowner’s insurance may cover you. However, if you’re renting from a commercial establishment, they will likely require you to have your own insurance.

There are a few things to consider when deciding whether or not to get insurance for your rented trampoline.

First, what does your renter’s insurance policy cover? You’ll want to make sure that it covers personal liability in case someone is injured while using the trampoline. Second, how much does the policy cover?

If it has a low limit, you may want to supplement it with an umbrella policy or another form of liability coverage. Finally, what is your deductible? If it’s high, you may end up paying most of the costs out-of-pocket if there is an accident.

In short, there is no one-size-fits-all answer to whether or not you need trampoline insurance when renting. It depends on many factors specific to your situation. Be sure to ask your rental company and insurer what their policies are before making a decision.

Trampoline Homeowners Insurance Liberty Mutual

As a trampoline owner, you’re probably well aware of the inherent risks that come with the territory. But did you know that your homeowners insurance policy may not provide coverage for injuries that occur on your trampoline?

That’s where Liberty Mutual comes in.

We offer comprehensive trampoline insurance that can help protect you from financial damages if someone is injured while using your trampoline.

Our trampoline insurance policies can help cover medical expenses, lost wages, and other damages that may be incurred as a result of an accident. We also offer liability coverage in case you’re sued for damages caused by the use of your trampoline.

So if you’re a proud owner of a backyard trampoline, be sure to give us a call to learn more about our comprehensive protection options. It’s just one more way we can help you enjoy peace of mind knowing you and your family are protected.

Does Allstate Allow Trampolines

According to Allstate, trampolines are not allowed on their property. This is because they are considered to be a liability. If someone were to get injured while on a trampoline, Allstate would be held responsible.

Therefore, it is in their best interest to not allow them on their property.

Credit: tgsinsurance.com

Does a Trampoline Effect on Homeowners Insurance?

No, a trampoline will not have an effect on your homeowners insurance. Your premiums are based on many factors, including the value of your home, the amount of coverage you need, and the location of your home.

Why Do Insurance Companies Care About Trampolines?

One of the most common reasons that people file insurance claims is for trampoline injuries. In fact, insurance companies view trampolines as one of the most dangerous pieces of backyard equipment and often exclude them from coverage. The reason why trampolines are so dangerous is because they offer a false sense of security.

People think that because they have pads and netting, there is no way they can get hurt. However, this could not be further from the truth. Trampolines are responsible for thousands of serious injuries every year, many of which require hospitalization or surgery.

There are several ways that people can get injured on a trampoline. The most common type of injury is when someone falls off of the trampoline and onto the ground. This can cause broken bones, concussions, and other serious injuries.

Another way people can get injured is by bouncing into the netting or pads surrounding the trampoline. This can result in cuts, bruises, and eye injuries. Finally, people can also get injured if multiple people are jumping on the trampoline at the same time and collide with each other in mid-air.

All of these types of injuries are expensive to treat and often require ongoing medical care. As a result, insurance companies view trampolines as a liability and something that should be avoided if possible. If you do have a trampoline in your backyard, make sure to take proper safety precautions such as never allowing more than one person to jump at a time and always supervising children while they are using it.

Why Do Trampolines Increase Homeowners Insurance?

Trampolines are often considered as a fun addition to any backyard. However, they can also be a liability. That’s because trampolines can cause injuries, and homeowners could be held liable if someone is injured while using the trampoline on their property.

For this reason, many homeowner’s insurance policies will either exclude coverage for trampoline-related incidents or charge higher premiums for properties with trampolines.

Can You Have a Trampoline in Your Backyard?

Yes, you can have a trampoline in your backyard! However, there are some things to keep in mind before making your purchase. First, check with your homeowners association (if you have one) to see if there are any restrictions on trampolines.

Next, take measurements of your backyard to make sure the trampoline will fit and that there is enough clearance around it for safety. Finally, consider what type of surface you will place the trampoline on – grass is softer than concrete but may require more upkeep; whereas, concrete provides a harder surface but could be more dangerous if someone falls off the trampoline. Ultimately, it is up to you to decide what works best for your family and backyard space.

Conclusion

Most homeowners insurance policies will cover damage caused by an enclosed trampoline on your property, but you may be required to inform your insurer of the trampoline. Some insurers may exclude coverage for trampolines or charge a higher premium for properties with trampolines.